Glenn Freeman of Livewire Markets recently interviewed Portfolio Manager Nick Thomson of the Lakehouse Global Growth Fund. The following article was featured in Livewire on April 28, 2023.

Value stocks maintain their lead over the Growth cohort, at least over a three-year timeframe. And that’s true across both the S&P 500 and the ASX 200 measures of the respective indexes – though the outperformance of Value is far more pronounced locally than in the US.

S&P Growth vs Value – 3 years

Source: SPGlobal.com

This reflects several factors, including the US’s far greater volume of listed companies and Australia’s higher proportion of Value stocks – particularly large-cap miners.

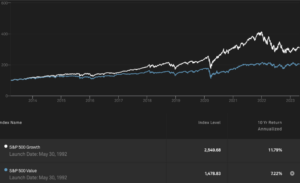

But over longer five-year and 10-year periods, Growth is well ahead, as shown in the graphic below.

S&P 500 Growth vs Value – 10 years

Source: SPGlobal.com

In any case, investors should approach discussions about the two investment styles with an appropriate level of agnosticism. As outlined in my recent article focusing on Value, even companies that can be neatly packaged up as either Growth or Value at one point in time can shift into the alternate category.

“Many try to bucket investors according to perceived growth or value styles, but in reality, growth and value are just two factors that many investors consider when analysing a business,” says Lakehouse Capital portfolio manager Nick Thomson.

He leans on a Warren Buffett-ism to further illustrate this:

“In our opinion, these two approaches are joined at the hip: Growth is always a component of the calculation of value, constituting a variable whose importance can range from negligible to enormous.”

What is Growth investing?

It’s about investing in companies with the potential to grow their revenue and earnings power at above-average rates for many years into the future. And as Thomson emphasises, two character traits are particularly useful here:

An optimistic mindset, and

Patience.

“Investors need to be patient and willing to hold onto winning companies for years to fully capture the benefits of compounding returns,” he says.

In an interview that touched on several areas, the following responses discuss:

– How the macro environment affects the relative performance of Growth stocks

– Six of the key metrics his team uses to weigh companies for portfolio inclusion

– Red flags to watch for, and

– Two of Thomson’s preferred global Growth stocks.

EDITED TRANSCRIPT

Aside from Technology, what other sectors are commonly associated with Growth?

There are several other sectors that can also provide attractive opportunities, such as consumer goods, healthcare, and financials. A few examples include;

LVMH (Consumer Discretionary): the world’s largest luxury goods company, leveraged to the rising demand for luxury goods from emerging market consumers, as well as from strong structural growth in categories like cosmetics and spirits.

Idexx Laboratories (NASDAQ: IDXX) (Healthcare): incredibly dominant veterinary diagnostics company that is benefiting from significant, sustainable growth in the pet care and animal health industry.

MarketAxess (NASDAQ: MKTX) (Financials): largest US electronic trading platform for fixed-income securities that is leading the secular transition from voice-based to electronic trading, which is still in its early stages.

Has higher inflation made it harder to identify investment opportunities?

We don’t believe so. What we have experienced since the beginning of 2022 was a dramatic repricing in the cost of capital as central banks worldwide lifted interest rates aggressively to combat inflation. Overseas, we have seen the Federal Reserve take the Fed Funds Rate to roughly 5% (from basically 0% in February 2022), whilst here at home the RBA has increased the cash rate by 3.5% since May last year. This is notable as the current RBA rate hike cycle is already greater than the four previous cycles, despite only initiating hikes 11 months ago.

In response, equities derated meaningfully and multiples compressed, particularly for long-duration growth names. So whilst this was a significant headwind for global equity markets over the last year, we believe the valuation adjustment has largely played out. In fact, we would argue that as we look forward, the indiscriminate selloff has actually created some wonderful opportunities for growth investors to pick up some of the world’s highest-quality businesses at attractive prices.

But coming back to your point on inflation, it would be remiss not to acknowledge that there is still heightened uncertainty around the economic outlook today.

While it’s difficult to predict how this will play out, our view is that operating conditions will become much more challenging for businesses going forward as they face persistent (albeit moderating) inflation and demand destruction kicks in following the rapid increase in interest rates.

Importantly, though, not all businesses are created equal, and the impact will not be uniform across the market.

As such, investors will benefit from being selective. It will be critical to own businesses with quality fundamentals: such as pricing power, secular growth and relatively inelastic demand, as those businesses will be best placed to neutralise the impact of inflation and continue growing despite broader economic weakness.

How do you find quality growth stocks? And are there any red flags?

We want to know what’s going to happen going forward, as a fast-growing business isn’t worth much if the growth isn’t durable. This is the hard part of investing, as growth is easy to measure, but durability isn’t. To try and unpack this you have to look towards qualitative factors, which is something our process emphasises.

When it comes down to it we are looking for a number of specific attributes (or markers) in the search for high-quality growth companies. At a high level, these include:

– Industry leaders that are gaining a share of growing markets

– Attractive returns on capital or unit economics

– Durable competitive advantages based within our fascinations framework (Intellectual Property, Networks and Loyalty) to defend those returns

– Pricing power

– Long runways for reinvestment, and

– Aligned and experienced management teams.

Red flags would include things such as a reliance on leverage, unproven or unattractive unit economics, concentrated customer bases, a high degree of cyclicality or a heavy dependence on a key supplier. By avoiding what we see as potential structural points of failure, we aim to significantly reduce the overall risk of the portfolio and limit our downside.

What’s your outlook for Growth versus Value in the next 12 to 18 months?

First off, I’ll caveat my response here by saying that I don’t believe we have any edge in predicting where the economy or interest rates will go over the next 12 months.

Inflation has likely peaked, at least in the US, and many tech-enabled businesses are, in our view, trading at attractive valuations as sentiment is still fairly negative.

We believe the current market is providing an attractive set-up for future investment returns for long-term, growth-focused investors. I say this as the macroeconomic environment does appear to be stabilising and it’s looking increasingly likely that we are approaching the end of the current interest-rate tightening cycle.

WHAT ARE TWO OF YOUR PREFERRED GROWTH STOCKS, AND WHY?

The following are two of the fund’s larger holdings today:

MercadoLibre

The leading e-commerce player in Latin America, we regard this as an attractive founder-led business that has methodically gained market share over the years.

Aside from just having the dominant marketplace that exhibits some powerful network dynamics, they also have a number of ancillary solutions, with payments, shipping and advertising. This is important to us, as not only do these ancillary businesses expand their addressable market but they also help increase the stickiness of the platform for both consumers and merchants alike.

The company has executed incredibly well so far and has recently shown a great balance of growth and profitability. In their Q4 2022 results, it reported record levels of operating income and margin expansion, all whilst maintaining 40%-plus top-line growth.

Despite the strong performance business-wise, MercadoLibre was not immune from the market selloff we saw in 2022. The company’s valuation compressed meaningfully and it’s now trading at roughly 5 times forward revenue, which is the cheapest it has been since the GFC.

Looking forward, we believe MercadoLibre is in an ideal position to capitalise on the significant opportunities ahead, especially given the relatively nascent penetration of e-commerce in the region and the size of the underbanked population.

Constellation Software

This is a self-funding, perpetual acquirer of leading, niche vertical market software businesses across a range of industries. Its portfolio of companies provides mission-critical solutions that generate sticky, recurring revenue streams that require minimal capital to maintain.

A key differentiating factor for CSU really comes down to having founder Mark Leonard at the helm, who truly is an exceptional CEO and capital allocator. He has instilled long-term thinking and rational decision-making across the organisation, allowing CSU to leverage a distributed acquisition strategy rather than Berkshire’s more centralised methods.

Over the last decade, the company has generated Amazon-like returns for shareholders, compounding operating cash flow at roughly 30% per annum and consistently delivering 25%-plus returns on invested capital. We believe the current environment – one of rising rates and diminishing liquidity – should favour CSU’s acquisitive appetite.

Lower valuations and less competition more broadly should enable them to deploy greater amounts of capital on more favourable terms. And if the company’s recent results are any guide, this certainly seems to be the case. They deployed US$1.9 billion in 2022, which for context, was more than three times what they put to work in 2020. ‘

Over the longer term, we remain confident in CSU’s ability to maintain growth at scale and find the business’s defensive and somewhat counter-cyclical nature appealing, particularly in these tough economic times.

Nick Thomson is the Portfolio Manager of the Lakehouse Global Growth Fund and holds units in the Fund, which owns shares in MercadoLibre, Constellation Software, LVMH, and MarketAxess. This article contains general investment information only (under AFSL 526842) and has been prepared without taking into account the reader’s financial situation.

Livewire gives readers access to information and educational content provided by financial services professionals and companies (“Livewire Contributors”). Livewire does not operate under an Australian financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given. Any advice on this site is general in nature and does not take into consideration your objectives, financial situation or needs. Before making a decision please consider these and any relevant Product Disclosure Statement. Livewire has commercial relationships with some Livewire Contributors.