The following article was featured in Livewire on November 22, 2023

Famously described as “the only free lunch investing” by Harry Markowitz, diversification is a mainstay of the Modern Portfolio Theory he developed in the 1950s. Most investors acknowledge the need to consider both risk and return by spreading capital across different companies, asset classes and geographies. Within the equities sleeve, this often means holding 40, 50 or even more stocks to spread risk.

But there is another school of thought that emphasises a more concentrated approach to stock selection, underpinned by strong views (high conviction) about their expected performance. This seems reasonable in a stable economic environment when markets are rising, but what about during periods of uncertainty?

To find out, I spoke with Donny Buchanan, portfolio manager of Lakehouse Capital, which adheres to a high-conviction investment approach across its Lakehouse Small Companies and Lakehouse Global Growth funds.

How does the macro environment influence your investing?

As Buchanan describes it, the effect is “less than you may expect,” describing his approach as “macro aware but not macro driven”. “We’re not oblivious to macroeconomic trends, particularly longer-term macro trends, however, we place considerably more resources into understanding business-level economic models than projecting and seeking to capitalise on (largely unknowable) macroeconomic outcomes,” Buchanan says.

Buchanan places strong emphasis on ensuring he doesn’t overreact to the noise, and on filtering out information that isn’t relevant to his team’s investment philosophy. He notes that many studies, including one titled Trading Is Hazardous To Your Wealth, highlight an inverse relationship between portfolio turnover and performance. That is, the more often you trade, on average, the worse your portfolio performs.

“Investors should be self-aware about overreacting to macro noise. High-turnover investors typically underperform the average patient investor,” Buchanan says. “At any point in time, there are hundreds of divergent “expert” macro opinions, where many – and at times, most – turn out to be incorrect!”

He also emphasises that most forecasts have an “incredibly short perspective” which means they often don’t align usefully with an investor’s time horizon. These points underpin Buchanan’s unequivocal view that “Maintaining a strong filter within persistent noise is paramount.”

All the game is in a few names

Buchanan points to research from Hendrik Bessembinder, who in 2017 released a study on the performance of 26,000 US companies between 1926 and 2016, to illustrate the following.

“Listed equities are a lot more like venture capital than most people realise – all the game is in a few names,” he says. “Not all industries are created equally. And not all companies are created equal. That is why we focus on building a concentrated portfolio of businesses that we believe can thrive over the long-term, regardless of which way the macroeconomic winds are blowing.”

Buchanan emphasises that while the Lakehouse approach “is well-supported by empirical research,” it doesn’t suit everybody. He also concedes that “greater concentration typically also makes for greater volatility, which can unsettle some investors.” “We believe concentrating capital in our 20 to 30 highest-conviction ideas is the best way to compound wealth over time,” Buchanan says. “And as it relates to risk, we believe a portfolio of market-leading companies can be both more concentrated and safer than a portfolio of ordinary companies over the long term.”

HOW THE LAST 12 MONTHS HAVE SHAPED LAKEHOUSE PORTFOLIOS

Buchanan says any macro-driven portfolio changes were “marginal rather than wholesale” in nature.

He focuses on companies with strong intellectual property and extremely loyal customers or network effects, which means the portfolio tends toward consumer, healthcare, technology and payments businesses.

“High inflation and rapidly rising interest rates, and the potential to eat into spending, saw us tilt the portfolios away from consumer exposure over the past couple of years,” Buchanan says. “That said, there remain some great consumer-facing businesses out there and share prices are reflecting lower expectations in the market for some of these businesses, so this could be subject to change.”

A sharper focus on profit

Buchanan notes this is one area where the team has “tightened up” in ensuring the businesses it backs have a “clear path to being self-funding.”

This contrasts with what he describes as “the heady days” of 2021 when Lakehouse’s long-term, growth-focused style provided more leeway to own fast-growing businesses with perhaps a longer path to profitability.

“As the cost of capital leapt off the floor, expectations shifted, purse strings tightened, and we exited some businesses where the path to breakeven wasn’t imminent,” Buchanan says. “A key learning over the past couple of years has been to remain conscious of not providing too much rope.”

Why balance sheets matter so much

Buchanan notes Lakehouse has also doubled down on some existing parts of its investment process. This includes an emphasis on businesses with conservative balance sheets.

“It’s a characteristic we’ve always sought out in businesses we own because a well-capitalised businesses will almost always live to see another day. Even better, they can play offence while others play defence,” he says.

“The market stopped caring as much about balance sheets when the cost of capital was on the floor – but like good manners, good balance sheets will never go out of fashion.”

HOW ARE YOU CURRENTLY POSITIONED?

The Lakehouse portfolios don’t look markedly different now versus 12 months ago, a point Buchanan emphasises by pointing out the turnover for both the Global Growth Fund and Small Companies Fund is around 18% since inception. This equates to an average holding period of 5.5 years for the former, and five years for the latter. This last figure is particularly high when you consider the greater propensity for investment theses to “break” when applied to younger, faster-growing companies in their earlier stages of existence.

“We clearly aren’t into making wholesale portfolio changes based on the macro,” Buchanan says. “If – and I emphasise if – rates have peaked, or are close to peaking, probabilistically, I think that environment should benefit growth investing. But it’s not something we are betting on. The focus remains on building a concentrated portfolio of businesses that we believe can thrive over the long-term regardless of which way the macroeconomic winds blow.”

Two companies on the Lakehouse radar

While emphasising that most companies in Lakehouse portfolios are highly profitable, Buchanan picks two stocks that many investors have so far ignored because they’re yet to turn a profit.

SiteMinder (ASX: SDR)

A Sydney-based company, SiteMinder provides a global e-commerce platform for hotels, and now occupies a top-five position within the Lakehouse Small Companies Fund.

“The business is delivering mid-20s top-line growth, with a healthy property subscriber pipeline (which has accelerated in recent quarters) that is supported by recent pricing and product initiatives that will drive growth in future years,” Buchanan says.

“The business is at a fundamental inflection point as it closes in on EBITDA and cash flow breakeven in the second half of fiscal 2024, including a more than 10 percentage point sequential improvement in underlying free cash flow margins in fiscal 2023. “We like the long-term prospects of the business and believe the company will gain a wider investor audience as it crosses into profitability and its attractive unit economics become more visible.”

Source: Market Index

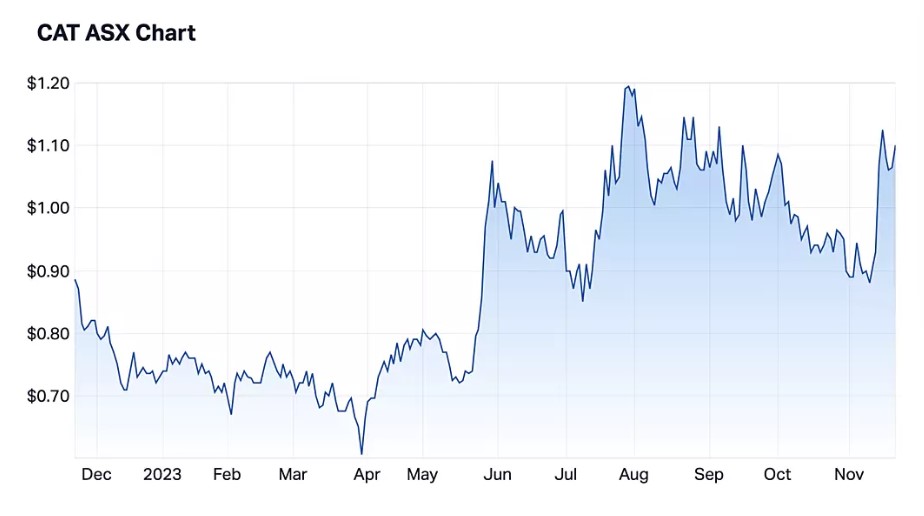

Catapult Group International (ASX: CAT)

A global sports analytics company, Catapult provides elite sporting organisations and athletes with detailed, real-time data and analytics. Buchanan notes the company falls “at the smaller end of our holdings,” and is a business that has been shunned by the market for the last five-plus years.

“And for good reason. It was historically guilty of being overly promotional, raising too much capital and allocating it poorly, lacking a path to profitability, some governance stumbles, and frequent management changes,” Buchanan says. “Fast forward to today and the business has taken steps forward with new management that have, so far, delivered what they said they would.”

Buchanan points to Catapult’s recent half-year results as evidence the business is “fundamentally moving in the right direction.” He highlights the top line is growing 20%, while the business is “reducing costs, delivering market-leading customer retention well into 90% plus, and quietly maintaining its market-leading position in elite sports wearables.”

“The business is selling for a very undemanding 2.5 times gross profit, growing at 20% plus, with 80% gross margins, low single-digit churn and plenty of room for a multiple re-rate as it inflects past free-cash-flow positivity.”

Source: Market Index

Donny Buchanan is the CIO and Portfolio Manager of the Lakehouse Small Companies Fund. This article contains general investment information only (under AFSL 526842) and has been prepared without taking into account the reader’s financial situation. The Lakehouse Small Companies Fund owns shares in both SiteMinder and Catapult.